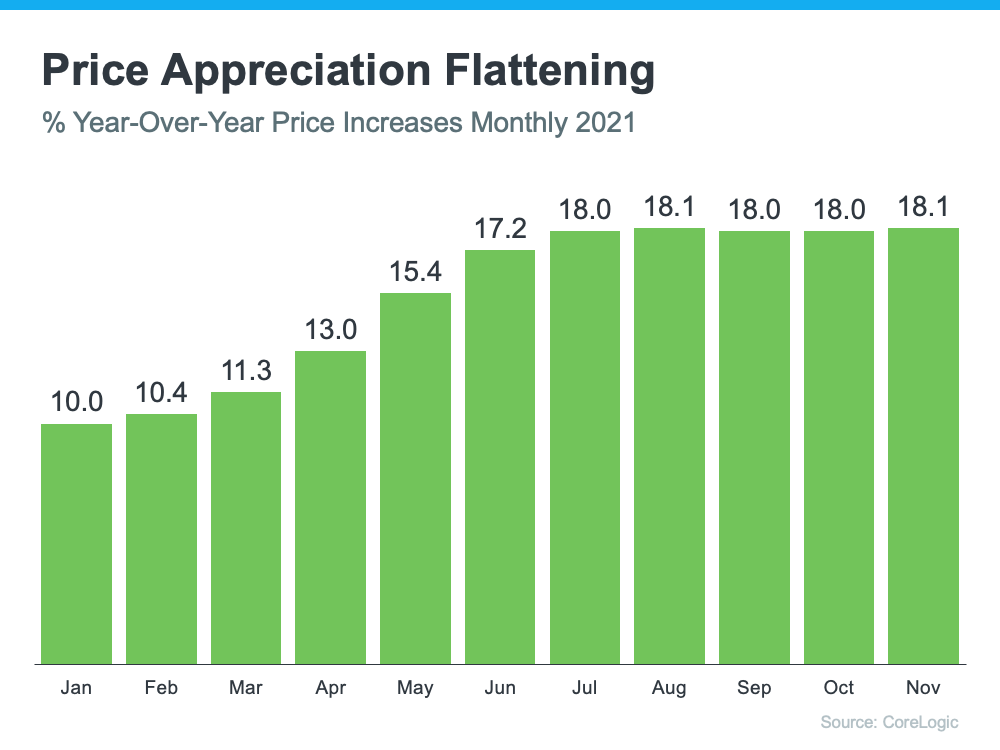

Are you curious about what will happen with home prices this year? After a couple of years of significant increases, experts predicted that the appreciation of home prices would slow down. However, the latest reports from CoreLogic, S&P Case-Shiller Price Index, and the FHFA Price Index indicate that while prices may have plateaued, appreciation has remained steady at around 18% over the last five months. The expected deceleration in pricing has yet to occur, and several factors contribute to this, including the lack of available listings, the absence of a surge in foreclosures, and the slowdown in new construction due to supply chain challenges. While price appreciation may slow in 2022, it is not expected to be swift or deep.

Home Price Appreciation in 2021

Double-digit increases

In 2021, the housing market saw double-digit increases in home prices. Many experts believed that this high rate of appreciation would decelerate or happen at a slower pace in the last quarter of the year. However, according to the latest Home Price Insights Report from CoreLogic, while prices may have plateaued, appreciation has definitely not slowed down. The graph in the report shows a steady year-over-year appreciation of around 18% over the last five months.

Steady appreciation at around 18%

The latest S&P Case-Shiller Price Index and the FHFA Price Index also indicate a slight deceleration in home price appreciation compared to the same time last year. However, both indices show continued strong price growth throughout the country. The FHFA reports that all nine regions of the country experienced double-digit appreciation, while the Case-Shiller 20-City Index reveals that all 20 metros had double-digit appreciation. Despite expectations of a slowdown, appreciation has remained steady at around 18%.

Deceleration Expectations vs. Reality

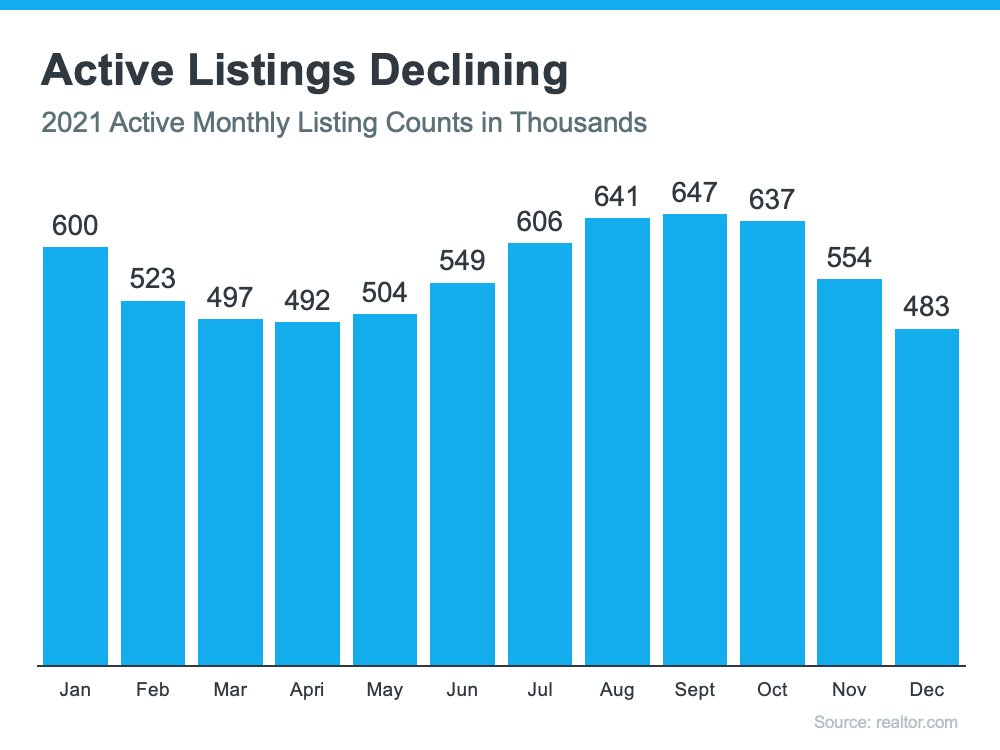

Projected increase in housing inventory

Experts had projected that the supply of housing inventory would increase in the last half of 2021. The idea was that as buyer demand decreased, as it historically does later in the year, supply would increase, leading to a deceleration in home price appreciation. However, this projected increase in housing inventory did not materialize.

Decrease in buyer demand

While buyer demand did decrease in the last quarter of 2021, it did not slow as much as expected. This sustained buyer demand played a role in preventing a deeper deceleration in home price appreciation.

Actual decrease in available listings for sale

Contrary to expectations, the number of available listings for sale actually decreased instead of improving. The graph provided in the report shows a decline in available listings at the end of the year. Several factors contributed to this limited increase in listings:

- Lack of surge in foreclosures: Despite the end of the forbearance program, there hasn’t been a surge of foreclosures, which could have increased the housing inventory.

- Slowdown in new construction: Supply chain challenges and other factors have led to a slowdown in new construction, resulting in fewer new homes entering the market.

- Continued concerns about the pandemic: Many homeowners who may have considered selling their homes have held back due to ongoing concerns about the pandemic. These concerns have not yet disappeared, causing the number of active listings to remain low.

Possible Impact of Omicron Variant

Drop in new listings during December

The report mentions that there was a drop in new listings during December. It raises the question of whether this sudden drop was due to the emergence of the Omicron variant of COVID-19 or simply the typical holiday season lull. While it is uncertain, the possibility of the Omicron variant impacting the housing market cannot be ruled out.

Uncertainty about impact on housing market

The presence of the Omicron variant and its potential effects on the housing market create uncertainty. It is unclear what impact it will have on home price appreciation in 2022. The report suggests that the appreciation might slow or decelerate in the coming year, but the extent and duration of the deceleration remain uncertain.

Expectations for Home Price Appreciation in 2022

Possible deceleration in appreciation

Based on the supply and demand dynamics, it is possible that home price appreciation will decelerate in 2022. The factors discussed earlier, such as the expected increase in housing inventory and the decrease in buyer demand, could contribute to this deceleration. However, the report cautions that the deceleration is unlikely to be swift or deep.

Unlikely to be swift or deep

While a deceleration in home price appreciation is expected, the report suggests that it is unlikely to be a drastic or significant drop. Supply and demand factors will continue to play a role, and the market will likely adjust accordingly. The sustained strong price growth seen throughout 2021 indicates a strong housing market that may experience a more gradual adjustment in the coming year.

Conclusion

In conclusion, the housing market experienced double-digit increases in home prices in 2021. Despite expectations of a deceleration, appreciation remained steady at around 18%. The limited increase in housing inventory can be attributed to factors such as the lack of foreclosures, slowdown in new construction, and continued concerns about the pandemic. The possible impact of the Omicron variant further adds uncertainty to the future of home price appreciation. While a deceleration is expected in 2022, it is unlikely to be swift or deep. The housing market will continue to evolve based on supply and demand dynamics.

Previous Article: Two Ways Homebuyers Can Win in Today’s Market

The previous article titled “Two Ways Homebuyers Can Win in Today’s Market” explored strategies for homebuyers to succeed in the current real estate market. It likely provided valuable insights and tips for those looking to navigate the competitive market and make informed decisions when purchasing a home.

Next Article: How Much Do You Need for Your Down Payment?

The upcoming article titled “How Much Do You Need for Your Down Payment?” will address an important question that many potential homebuyers have. It will provide guidance on determining the amount of money needed for a down payment when purchasing a home. This information will be valuable for individuals who are in the planning stages of buying a home and want to ensure they have a clear understanding of the financial requirements involved.

Buyers Want To Know: Why Is Housing Supply Still So Low?

The article titled “Buyers Want To Know: Why Is Housing Supply Still So Low?” will delve into the factors contributing to the current low housing supply. It will explore reasons such as limited foreclosures, challenges in new construction, and lingering concerns about the pandemic. By addressing these factors, the article will provide buyers with a better understanding of why housing supply remains limited and how it can impact their homebuying journey.

With Mortgage Rates Climbing, Now’s the Time To Act

The article titled “With Mortgage Rates Climbing, Now’s the Time To Act” will emphasize the importance of taking action in the face of rising mortgage rates. It will highlight the potential impact of these rising rates on affordability and encourage readers to seize the opportunity to secure a mortgage while rates are still relatively low. The article will provide insights and advice on navigating the current mortgage rate environment to make informed decisions.