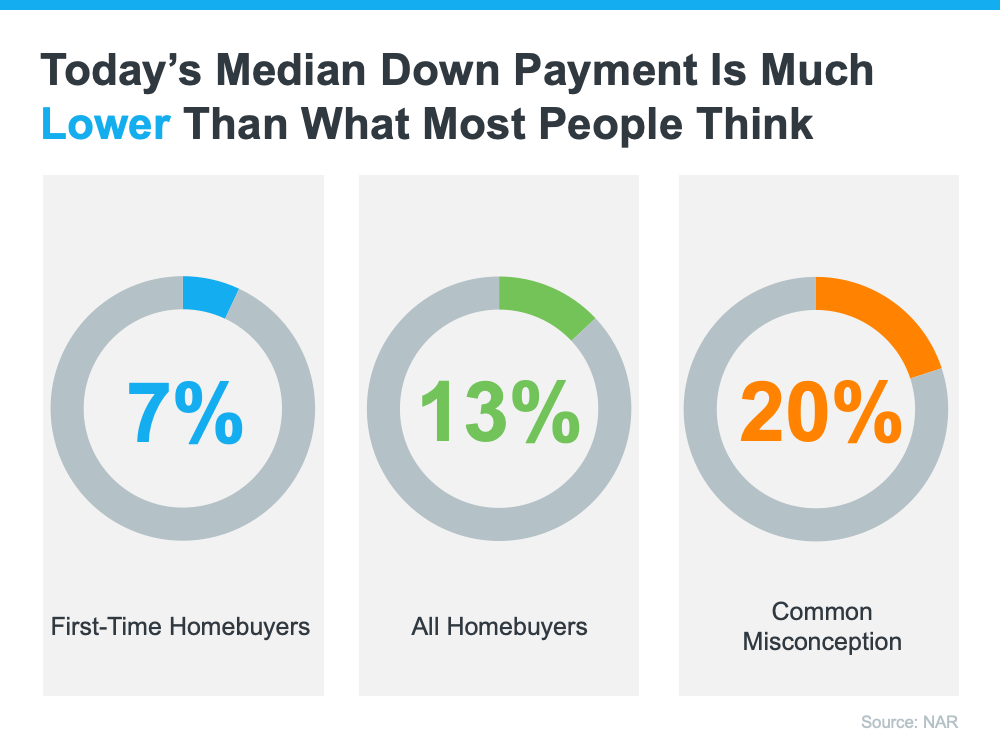

Are you planning to buy a home but unsure about how much you need for a down payment? Contrary to common belief, putting 20% down is not always necessary. According to Freddie Mac, the most damaging down payment myth is the belief that 20% is required. In fact, the median down payment for home buyers is only 13% and even lower for first-time buyers at 7%. This means that you could be closer to your homebuying dream than you realize. There are low down payment options available, such as programs for qualified buyers with down payments as low as 3.5% and VA loans and USDA loans with no down payment requirements for eligible applicants. To understand your options better, it’s essential to do your research and work with a real estate advisor. So, if you’re ready to explore your down payment options, let’s connect and start the conversation about purchasing your dream home.

Common Misconception About Down Payment

20% Down Payment Myth

One of the most common misconceptions about down payments is the belief that you need to put down 20% of the purchase price of a home. This myth has been perpetuated for years and has led many potential homebuyers to believe that they must save up a significant amount of money before they can even begin the homebuying process. However, according to Freddie Mac, this is not the case. They state that the belief that 20% is necessary is the most damaging down payment myth because it stops the homebuying process before it can even start. Unless specified by your loan type or lender, it’s typically not required to put down 20% when buying a home.

Median Down Payment Since 2005

Contrary to popular belief, the median down payment for homes has not been over 20% since 2005. According to the Profile of Home Buyers and Sellers from the National Association of Realtors (NAR), the median down payment for homes in recent years has actually been much lower than 20%. In fact, the median down payment is only 13% overall, and for first-time homebuyers, it’s even lower at only 7%. This means that the majority of buyers are putting down far less than 20% on their home purchases.

Low Down Payment Options

If you’re one of the many potential homebuyers who don’t have a large amount of savings to put towards a down payment, there are still options available to you. There are programs specifically designed for qualified buyers that offer low down payment options, with some programs allowing down payments as low as 3.5%. The Federal Housing Administration (FHA) offers loans with a minimum down payment of 3.5% for eligible borrowers. This means that if you’re buying a $200,000 home, you would only need to put down $7,000.

In addition to low down payment programs, there are also special loans available for certain groups of people. For example, VA loans and USDA loans have no down payment requirements for qualified applicants. VA loans are available to active-duty military personnel, veterans, and certain surviving spouses, while USDA loans are offered to low-income rural homebuyers. These programs can be a great option for those who are eligible, as they allow you to purchase a home without needing to save up a large down payment.

Researching Down Payment Assistance Programs

If you’re not sure where to start in your search for low down payment options, there are resources available to help you. Websites like downpaymentresource.com provide information on down payment assistance programs that may be available in your area. These programs are designed to help eligible homebuyers cover the cost of their down payment, making homeownership more accessible and affordable.

In addition to using online resources, it’s also helpful to work with a real estate advisor who can guide you through the homebuying process and help you understand your options. A real estate advisor will have knowledge and experience in the local market and can provide valuable insights into down payment assistance programs that you may qualify for. They can also help you determine what you may be eligible for based on your financial situation and goals.

Understanding Your Options

When it comes to your down payment, it’s important to fully understand all of your options. In addition to exploring low down payment programs and down payment assistance programs, there are other factors to consider. For example, you may be able to use gift funds from a family member towards your down payment, or you may qualify for a down payment grant. It’s important to explore all of these possibilities and determine what may be the best fit for your situation.

To gain a better understanding of your options, it’s essential to do your homework. This includes conducting research and due diligence to fully understand the different programs and resources available to you. It’s also important to seek professional advice from a real estate advisor or mortgage lender. They can help answer any questions you may have and guide you through the process of determining what you may qualify for.

Benefits of a Lower Down Payment

Choosing a lower down payment option offers several benefits. First and foremost, it brings you one step closer to achieving your dream of homeownership. With a lower down payment, you may be able to enter the real estate market sooner and start building equity in your own home.

A lower down payment also provides flexibility in budgeting and saving. Instead of having to save up a large lump sum for a down payment, you can allocate those funds towards other purposes, such as home improvements or paying off debt. This flexibility can make the homebuying process more manageable and less financially burdensome.

Importance of Doing Your Homework

When it comes to your down payment, it’s crucial to do your homework and conduct thorough research. This includes not only researching down payment programs and resources but also understanding the homebuying process as a whole. By doing your due diligence, you will be better equipped to make informed decisions and find the best option for your specific needs and goals.

Additionally, seeking professional advice is essential. A real estate advisor can provide valuable guidance and assistance throughout the homebuying process. They can help you navigate the complexities of the real estate market, guide you through the application process for down payment assistance programs, and ensure that you are making informed decisions every step of the way.

Exploring Down Payment Assistance Programs

There are a variety of down payment assistance programs available to help potential homebuyers with their down payments. These programs vary by location but can provide financial assistance to qualified buyers, making homeownership more attainable.

Researching available programs and resources is a crucial step in exploring your options. Websites like downpaymentresource.com provide information on down payment assistance programs that may be available in your area. These programs can help bridge the gap between your savings and the amount needed for a down payment, allowing you to achieve your homeownership goals sooner.

In addition to researching available programs, it’s important to understand the qualifying criteria and application process for each program. Some programs may have income limits or specific requirements, so it’s essential to review the eligibility criteria before applying. Working with a real estate advisor can also be beneficial in navigating the process and ensuring that you meet all requirements.

Working with a Real Estate Advisor

Choosing to work with a real estate advisor can provide numerous benefits throughout the homebuying process. A real estate advisor is a licensed professional who specializes in assisting buyers with their real estate needs. They have extensive knowledge and experience in the local market and can provide valuable guidance and support.

One of the key benefits of working with a real estate advisor is the access to their expertise. They can help you explore low down payment options and down payment assistance programs that you may not have been aware of. They can also guide you through the application process and ensure that you are taking advantage of all available resources.

Additionally, a real estate advisor can help you navigate the homebuying process. They can assist with finding and touring homes, negotiating purchase agreements, and coordinating inspections and appraisals. Having a knowledgeable professional by your side can make the entire process smoother and less stressful.

Debunking the 20% Down Payment Myth

It’s important to dispel the common misconception that a 20% down payment is always required when buying a home. While a larger down payment can have benefits, such as a lower monthly mortgage payment and avoiding private mortgage insurance (PMI), it is not necessary for everyone.

Understanding alternative options is key to debunking this myth. There are a variety of low down payment programs available that can help you purchase a home with less money down. Exploring these options and understanding the potential benefits and drawbacks can help you make an informed decision about your down payment.

Start the Conversation About Your Down Payment

If you’re considering buying a home, it’s important to start the conversation about your down payment. Connecting with a real estate professional can help you determine your options and create a plan that aligns with your specific needs and goals. They can provide personalized guidance based on your financial situation and help you navigate the homebuying process with confidence.

In conclusion, it’s crucial to understand that a 20% down payment is not always necessary when buying a home. There are a variety of low down payment options and down payment assistance programs available to help you achieve your homeownership goals. By doing your research, seeking professional advice, and exploring your options, you can find the best down payment solution for your situation.