In the midst of the COVID-19 pandemic, concerns arose that the housing market would face a wave of foreclosures once mortgage forbearance programs came to an end. However, recent data suggests that this may not be the case. Unlike the last housing crash, where over nine million households lost their homes, most homeowners who entered forbearance plans have either caught up on payments or received a restructured loan that allows them to make payments again. Additionally, those who are still in forbearance have the opportunity to negotiate repayment plans with their lenders. Furthermore, many homeowners have gained significant equity in their homes due to rising home prices, giving them the option to sell their homes and avoid foreclosure. The current real estate market is also equipped to absorb new listings, making a wave of foreclosures less likely to cause a downturn.

Fewer Homeowners in Trouble This Time

After the last housing crash over 15 years ago, where over nine million households lost their homes, there was concern that the end of the forbearance program during the pandemic would lead to a wave of foreclosures. However, data from the Mortgage Bankers Association (MBA) shows that this is not the case. Most homeowners who entered the forbearance program have either fully caught up on their payments or have negotiated a restructured loan plan with their bank. According to the MBA, the majority of people who exited the forbearance program from June 2020 to November 2021 did so with a plan in place, with only a small percentage still in trouble without a loss mitigation plan.

Negotiating Repayment Plans

While there are still a significant number of mortgages in forbearance, homeowners who remain in the program still have the opportunity to negotiate a suitable repayment plan with their servicing company. These servicing companies are under pressure from both federal and state agencies to find solutions for homeowners. The Consumer Financial Protection Bureau and state Attorneys General are adopting a zero tolerance approach to mortgage servicing enforcement, which means that foreclosure activity is likely to be limited in 2022 as servicers explore all possible loss mitigation options. Homeowners should take advantage of this opportunity to negotiate a plan that works for them.

Homeowners with Sufficient Equity

For homeowners who are unable to negotiate a solution and those who have left the forbearance program without a loss mitigation plan, many will still have the option to sell their homes due to the equity they have gained. Rising home prices over the last two years have led to record amounts of equity for homeowners. This means that even if they are unable to continue making mortgage payments, they can sell their homes and leave the closing with cash instead of facing foreclosure. This is a positive outcome for homeowners who are in a difficult financial situation.

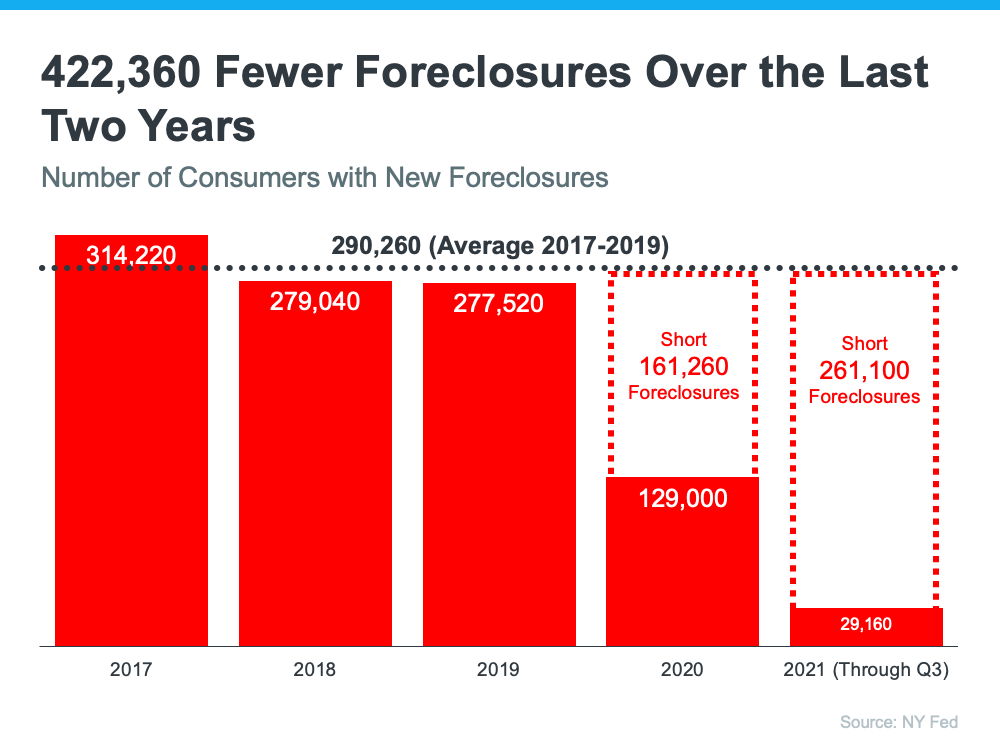

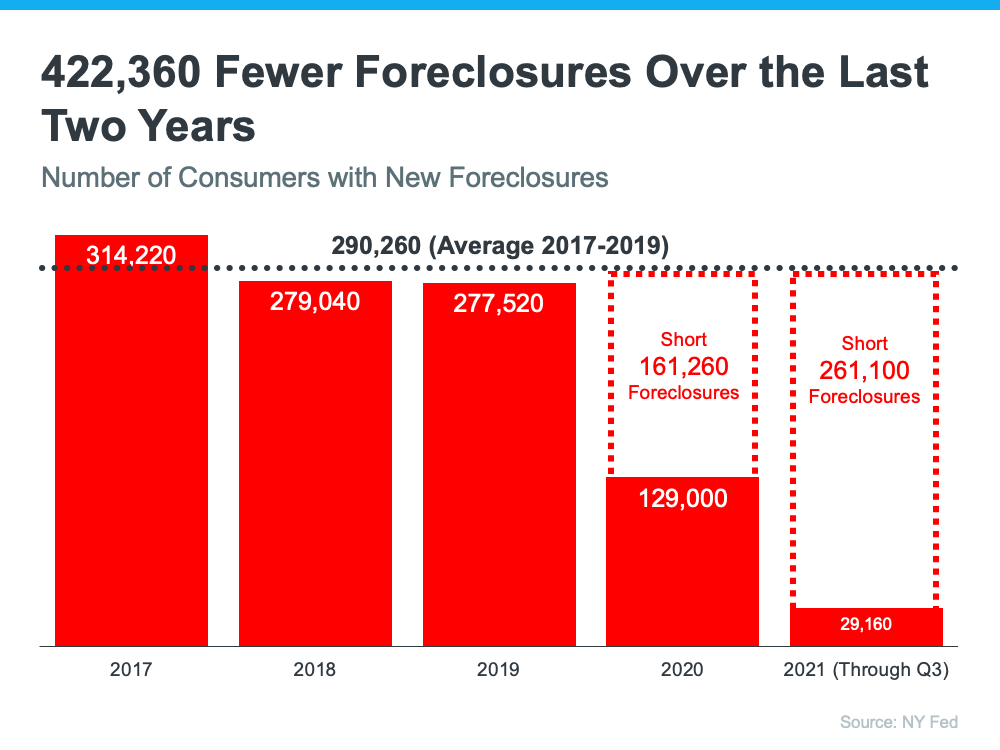

Fewer Foreclosures Over the Last Two Years

One of the benefits of the forbearance program is that it has prevented a significant number of foreclosures from hitting the market. Prior to the pandemic, households experiencing financial difficulties would have been at risk of foreclosure. However, the forbearance program has given these homeowners an extra two years to work out a plan with their lenders and get their finances in order. This has prevented over 400,000 foreclosures from entering the market. Without the forbearance program, the real estate market would have had to absorb these foreclosures, which could have had a negative impact on housing inventory and prices.

Current Market’s Ability to Absorb New Listings

Unlike in 2008 when foreclosures added to an already oversupplied housing market, the current market is in a completely different situation. The demand for housing is high, while the housing inventory is low. The latest Existing Home Sales Report from the National Association of Realtors reveals that there is a severe shortage of housing inventory, with only a 2.1-month supply available. This is significantly lower than the balanced market level of a six-month supply. Even if a million homes were to enter the market, there still would not be enough inventory to meet the current demand. This means that the end of the forbearance program will not cause any disruption in the housing market.

End of Forbearance Plan Won’t Cause Disruption

Contrary to the belief that the end of the forbearance program would lead to a wave of foreclosures, the data shows that foreclosure starts have declined despite hundreds of thousands of borrowers exiting the program. This suggests that the narrative that forbearance equals foreclosure was incorrect. The safeguards put in place by federal and state agencies, as well as the ability of homeowners to negotiate repayment plans or sell their homes, have prevented a foreclosure crisis from occurring. Homeowners who are still in the forbearance program should not be concerned about a sudden wave of foreclosures and should explore their options for negotiating a repayment plan.

Mortgage Forbearance Plan Data

The data from the forbearance program shows that there are a variety of outcomes for homeowners who exited the program. Some homeowners were able to fully catch up on their payments, while others negotiated work-out repayment plans with their lenders. Some received loan deferrals or modifications, while a small percentage sold their homes through short sales or deed-in-lieu. It is important for homeowners to understand the different outcomes and options available to them if they are still in the program. The data shows that there are opportunities for negotiation and assistance.

Negotiation Opportunities for those Still in the Program

For homeowners who are still in the forbearance program, there are options available to help them navigate their financial situation. Homeowners can negotiate repayment plans with their lenders, taking into account their current financial circumstances and the terms of their mortgage. Federal and state agencies are enforcing mortgage servicing to ensure that servicing companies are working with homeowners to find suitable solutions. Homeowners should reach out to their servicing company and explore the options available to them. It is important to seek assistance and guidance during this time.

Record Equity Gains for Homeowners

One positive outcome of the rise in home prices over the last two years is that homeowners have gained record amounts of equity in their homes. This equity not only helps homeowners transition out of forbearance and avoid foreclosure but also enables them to continue building their wealth. Homeowners who have sufficient equity in their homes have the option to sell and use the proceeds to improve their financial situation. This is a valuable opportunity for homeowners to take advantage of the current market conditions and secure their financial future.

Impact of Foreclosures on Housing Inventory

Foreclosures can have a significant impact on housing inventory levels. In 2008, the addition of foreclosures to an already oversupplied housing market led to a surplus of homes for sale. This excess inventory caused prices to depreciate. However, the current market is the complete opposite. The housing inventory is severely understocked, with a supply of only 2.1 months. Even if a significant number of foreclosures were to enter the market, the demand for housing is so high that there still would not be enough inventory to meet the needs of buyers. This means that the impact of foreclosures on housing inventory will be minimal.

In conclusion, there is no need to worry about a wave of foreclosures in the housing market. The majority of homeowners who entered the forbearance program have negotiated a suitable solution with their lenders or have sufficient equity in their homes to sell and avoid foreclosure. The current market conditions, including low housing inventory and high demand, make it unlikely that the end of the forbearance program will cause any disruption. Homeowners who are still in the program have options available to negotiate repayment plans and should seek assistance from federal and state agencies. The record equity gains for homeowners also provide an opportunity to improve their financial situation. The impact of foreclosures on housing inventory will be minimal due to the current shortage of inventory.